The taxpayers have to file returns on the basis of the income earned in a financial year and the kind of entity they fall under. Let’s explore in detail the taxpayers who are required to file Form ITR-5 and other relevant instructions pertaining to the same. The various provisions and sections mentioned in this article are of the Income Tax Act, 1961.

Get a quote from Kanakkiyal in less than 24 hours.

The following are eligible for filing Form ITR-5:

It is pertinent to mention that a person who is required to file return of income under Section 139(4A) or 139(4B) or 139(4D) cannot use Form ITR-5 for filing return.

Form ITR-5 is an elaborate form that has primarily two parts. There are also multiple schedules in the Form:

| Part/Schedule | Explanation |

|---|---|

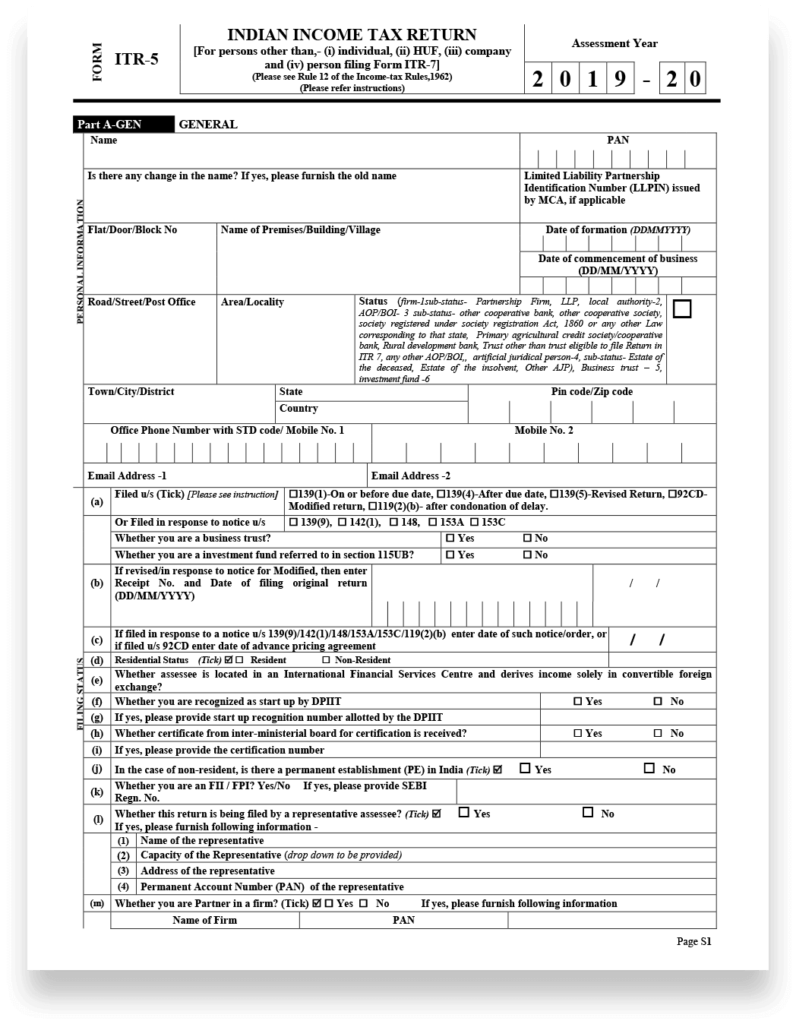

| Part A-GEN | General information |

| Part A-BS | Balance sheet as on the last day of the previous year |

| Part A – Manufacturing Account | Manufacturing Account for the previous financial year |

| Part A – Trading Account | Trading Account for the previous financial year |

| Part A – P&L | Profit and Loss for the previous financial year |

| Part A – OI | Other Information (this is optional in case the assessee is not liable for audit under Section 44AB) |

| Part A – QD | Quantitative Details (this is optional in case the assessee is not liable for audit under Section 44AB) |

| Schedule- HP | Income computation under the head House Property |

| Schedule – BP | Income computation under the head – Business or Profession |

| Schedule DPM | Computing depreciation on Plant & Machinery in accordance with the Income Tax Act |

| Schedule DOA | Computation of Depreciation on other assets as per the Income Tax Act |

| Schedule DEP | Summary of depreciation on all assets as per the Income Tax Act |

| Schedule DCG | Computing of deemed capital gains on the sale of depreciable assets |

| Schedule ESR | Making deduction under Section 35 |

| Schedule- CG | Computing income under the head Capital Gains |

| Schedule- OS | Computing income under the heading Income from other sources |

| Schedule CYLA | Income statement after setting-off losses for the current year |

| Schedule BFLA | Income statement after setting off the unabsorbed losses of the previous year(s) |

| Schedule CFL | Statement of losses which is to be carried forward to the future years |

| Schedule UD | Statement regarding unabsorbed depreciation |

| Schedule ICDS | |

| Schedule 10AA | Computing the deduction under Section 10AA |

| Schedule 80G | Statement pertaining to donations which are entitled for deduction under Section 80G |

| Schedule RA | Statement of donations made to research associations etc. which are entitled for deduction under Sections 35(1)(ii), 35(1)(iia), 35(1)(iii) or 35(2AA) |

| Schedule 80IA | Computing deduction to be made under Section 80IA |

| Schedule 80IB | Computing deduction under Section 80IB |

| Schedule 80IC/80IE | Computing deduction under Section 80IC/80IE |

| Schedule 80P | Deductions under Section 80P |

| Schedule VIA | Deductions statement under Chapter VIA |

| Schedule AMT | Computing Alternate Minimum Tax under Section 115JC of the Income Tax Act |

| Schedule AMTC | Calculation of tax credit under Section 115JD |

| Schedule SPI | Statement of income that arises to minor child/spouse/son’s wife or any other person or AOP that is to be included in the income of the assessee in Schedules HP, CG, OS |

| Schedule SI | Statement of income which is subject to chargeability at special tax rates |

| Schedule IF | Details of partnership firms in which assessee is partner |

| Schedule EI | Exempt Income Details |

| Schedule PTI | Details of pass through income from investment fund or business trust under Section 115UA, 115UB |

| Schedule FSI | Details of income that accrues or arises out of India |

| Schedule TR | Details of any taxes that have been paid outside India |

| Schedule FA | Details of any Foreign assets or income from a source outside India |

| Schedule GST | Details of turnover/gross receipts reported for GST |

| Part B-TI | Summary of total income and tax computation on the basis of the income that is chargeable to tax |

| Part B – TTI | Computing the tax liability on total income |

| Tax Payments | Advance Tax, Tax Deducted at Source and Self-assessment tax |

The audit report can be generated online while filing the return. For this click on Audit Report, then 3CA-3CD and finally on generate report.

Form ITR 5 cannot be filed by individual taxpayers, HUF, Company, Persons who have to file tax return in Form ITR-7, i.e., under Sections 139(4A), 139(4B), 139(4C), 139(4D), 139(4E) or 139(4F).

ITR-5 must be filed by firms, LLPs (Limited Liability Partnerships), AOPs (Association of persons) and BOIs (Body of Individuals), artificial juridical person, cooperative society and local authority.

Click the button and enter your details in the appearing form. We will contact you within 24 hours to schedule a free consultation call and discuss your needs.

Get a quote from Kanakkiyal in less than 24 hours.